Credit Saison India: A Comprehensive Loan Application

Credit Saison India is a loan application launched by Kisetsu Saison Finance (India) Pvt. Ltd., designed specifically to meet the diverse financial needs of Indian users. As one of Indias leading new lending groups, this application strictly adheres to the Reserve Bank of Indias fair practice guidelines, ensuring transparency and fairness in all digital lending products. Credit Saison India helps users manage their personal finances and achieve their dreams by providing easy-to-use loan services. Whether its personal consumption, household expenses, or urgent financial needs, the platform can quickly respond and provide solutions.

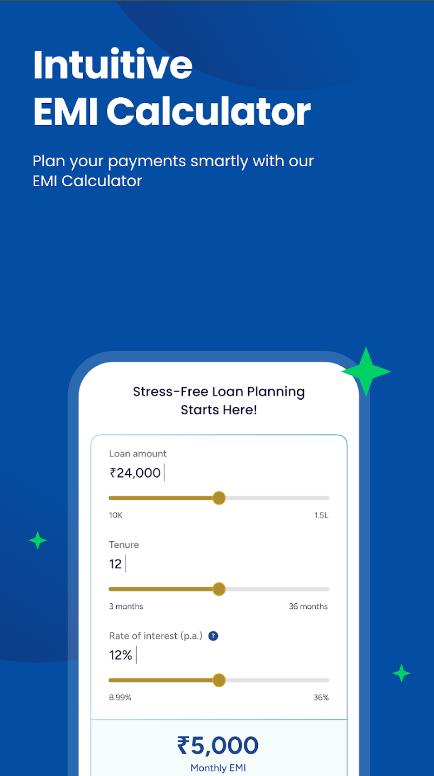

Users can utilize a smooth EMI calculator to quickly calculate monthly repayment amounts and easily plan financial expenses. At the same time, the application also supports real-time credit score updates, helping users to timely understand their credit status and make more informed lending decisions. Credit Saison India is committed to providing users with an efficient, transparent, and convenient loan service experience centered around innovative technology and user-friendly design.

App Features

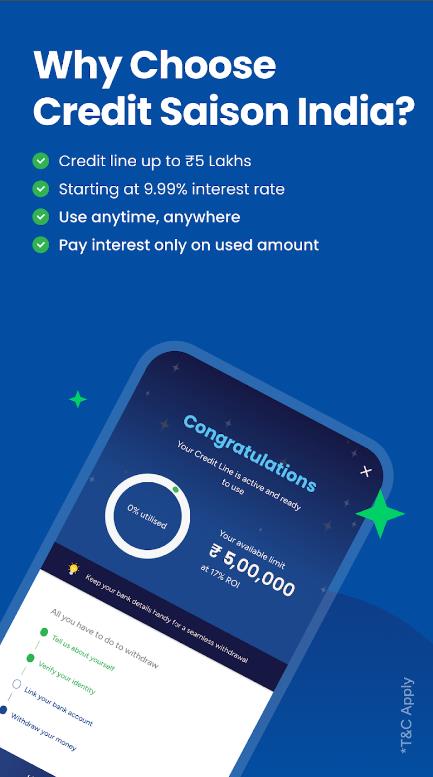

Comprehensive Loan Options: Whether its personal loans, small loans, or emergency funding support, Credit Saison India offers a variety of loan products to meet the needs of different users.

Real-Time Credit Score Update: Users can view changes in their credit score at any time, understand their credit health status, and have a reliable basis for future financial decisions.

Flexible EMI Calculator: The intuitive and easy-to-use EMI calculator allows users to easily calculate monthly repayment amounts, helping them plan budgets and make reasonable loan choices.

App Experience

User-Friendly Interface: The application design is simple and clear, allowing users to easily complete loan applications and management without any complex operations.

Quick Approval and Disbursement: Advanced technology is used for credit evaluation and approval, significantly reducing disbursement time and allowing users to obtain the required funds as early as possible.

Security Protection: Multiple encryption and data protection measures ensure the security of users personal information and financial data, allowing users to use it with confidence.

App Play

Simple and Intuitive Loan Application Process: Only a few steps are needed to complete the loan application, and the system will guide users to complete all necessary steps, simplifying the traditional loan process.

Personalized Financial Advice: The application provides personalized loan advice and repayment reminders based on the users credit score and loan history, helping users optimize financial management.

Convenient Account Management: Users can view their loan balance, repayment plan, and payment history in real-time within the application, fully understanding their financial situation.

App Test

Functional Testing: Regularly conduct application functional testing to ensure smooth operation of all services and provide users with the best user experience.

User Feedback Optimization: Emphasize user feedback, continuously optimize application functions and user interfaces to better meet user needs.

Compliance Testing: Ensure that the application strictly complies with all regulatory requirements of the Reserve Bank of India, and continuously maintains high standards of financial compliance and transparency.