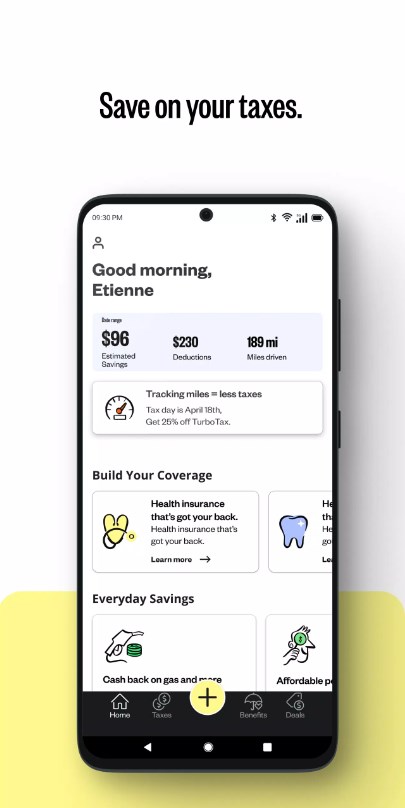

Stride Mileage & Tax Tracker: Effortless Financial Management for Freelancers

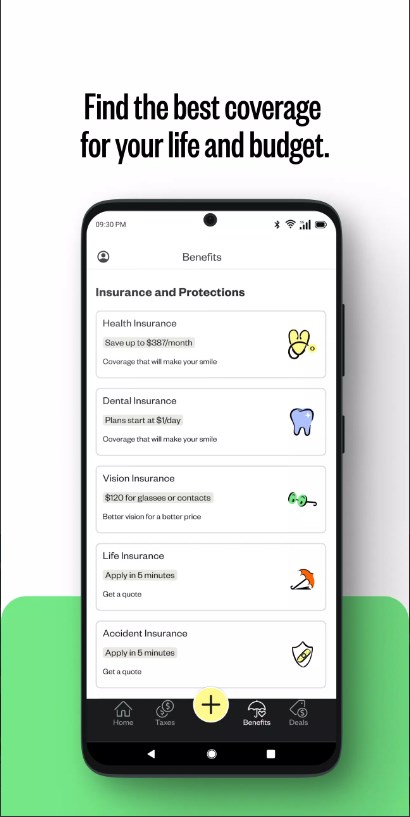

Discover the power of Stride, a comprehensive mileage tracker designed specifically for freelancers and self-employed professionals. This cutting-edge tool streamlines the process of identifying and declaring business expenses, making tax filing a breeze. With Stride, you can easily track expenses, calculate mileage reimbursements, and ensure that you dont miss out on any possible deductions. Most users find they save an average of $4000 or more each tax season with Stride! Whether youre an Uber driver, freelance writer, or another type of independent worker, Stride simplifies your tax life.

App Features

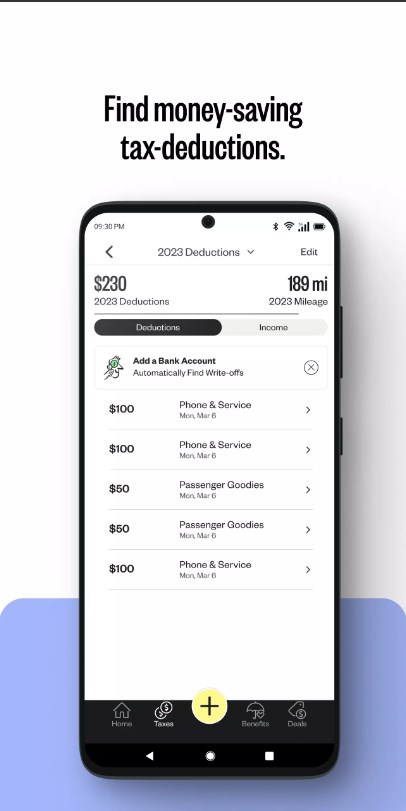

1. Automatic Mileage Tracking: The app utilizes built-in GPS technology to automatically record every mile you travel for work. This feature ensures all mileage reimbursements are accurate and complete.

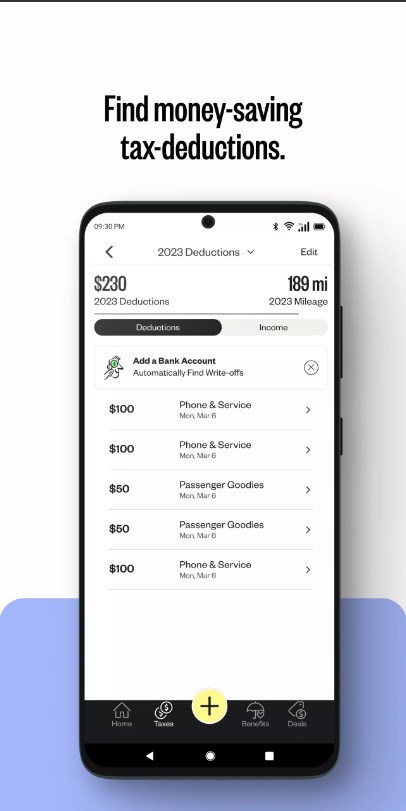

2. Expense Classification Management: A user-friendly classification system helps you categorize various business expenses, providing a clear overview and detailed understanding of your spending.

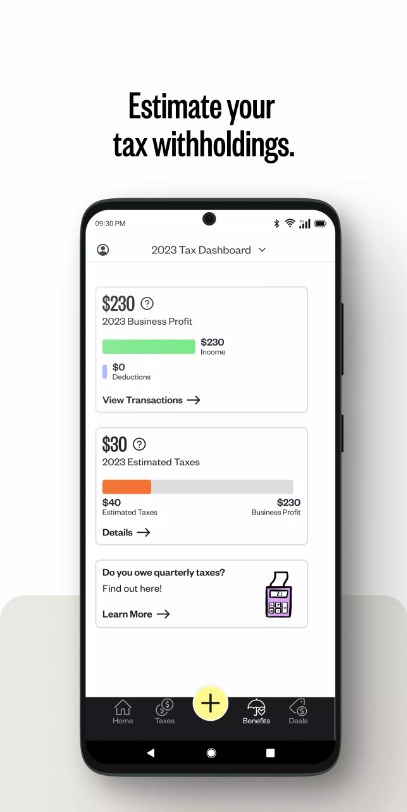

3. Personalized Tax Advice: Based on your expenses and income, Stride offers tailored tax optimization advice, allowing you to take full advantage of tax deduction policies and minimize your tax liability.

App Usage

1. Easy Expense Recording: Recording expenses is simple and straightforward. Whether its fuel, car repairs, or equipment purchases, all expenses are quickly and easily logged.

2. Real-Time Mileage Calculation: Once the app is open, it automatically starts recording your travel mileage. This means you can focus on your work without worrying about tracking miles.

3. Quick Report Generation: At tax time, generate detailed tax reports with a single click. These reports can be shared directly with your accountant or tax agency, eliminating the need for manual calculations.

App Experience

1. User-Friendly Interface: The app features a clean, simple interface and intuitive operation guide, making it accessible even to tech novices.

2. Efficient Automation: Advanced technology ensures that mileage tracking and expense recording are automated, so you never miss any important data.

3. Real-Time Data Synchronization: Your data is synchronized to the cloud in real-time, ensuring secure and convenient access from any device, even if you lose your phone or switch devices.

App Highlights

1. Significant Tax Savings: Users can save an average of $4000 or more each year on taxes, enhancing the financial benefits for freelancers significantly.

2. Cross-Platform Compatibility: Stride is compatible with both iOS and Android devices, allowing you to manage your financial information anytime, anywhere.

3. Timely Support and Updates: Professional customer support is available to address user queries promptly. The app is regularly updated to ensure you always have access to the best version.